Sentiment in the oil markets is clearly bullish, with WTI and Brent on track to post another weekly gain.

Friday, July 5, 2024

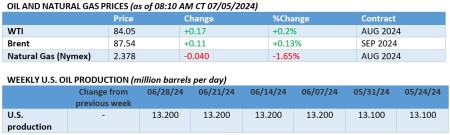

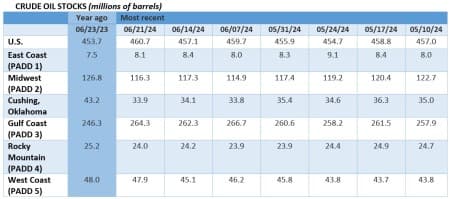

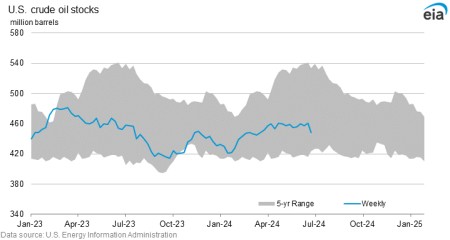

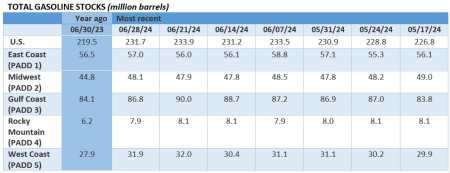

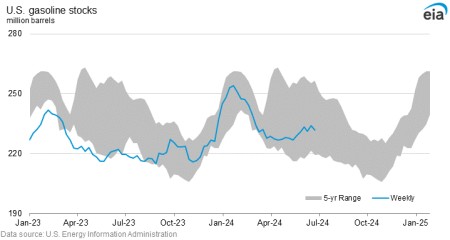

While market activity was relatively weak with US markets closed for the Independence Day holiday, the triple-combination of lower US crude, gasoline and oil inventories has fueled hopes in the market that summer demand will not it was just as bad after all. Amid growing optimism for a US interest rate cut in September, crude oil is set for another weekly gain with ICE Brent ending the week above $87 a barrel.

Wildfires again threaten Canada’s manufacturing. Canada’s oil major Suncor Energy (TSO:SU) has shut down its 215,000 b/d Firebag oil sands field in Alberta due to wildfires 5 miles away, with July expected to see an extended period of hot, dry weather exceeding 86°F.

Middle East NOCs fight for Santos. Amid reports that Saudi Aramco may be interested, the UAE’s national oil firm ADNOC has also expressed willingness to bid for the Australian oil and gas company. Santos (ASX:STO) as talks to merge the latter with Woodside did not materialise.

Traders despair over Nigeria’s petrol debts. Nigeria’s total debt to petrol suppliers has surpassed $6 billion, doubling in less than four months, after the country’s national oil company NNPC was forced to curb runaway prices after the Tinubu government ended fuel subsidies last year .

Bolivia seeks Russian help to end fuel crisis. Bolivia’s state energy firm YPFB is seeking to attract investment in its oil and gas sector, with gas production halved in a decade and oil output at its lowest level since the 1990s, just as Russia began supplying the country with diesel.

Saudi Arabia aims for a 60% increase in gas production. Saudi Aramco plans to increase natural gas production by 60% by the end of this decade, currently producing about 11 billion cubic meters per day, thanks to the $100 billion Jafurah project, but also investments in LNG operations abroad.

Venezuela maintains stable gross output. Defying White House sanctions, Venezuela managed to increase its oil output slightly last month to 922,000 barrels per day, from 912,000 barrels per day in May, thanks to increased activity in new drilling and well work.

Alaska Sues Biden Administration The state of Alaska is suing the Biden administration over its recent decision to limit access to drilling and mining in the Alaska National Petroleum Reserve (NPR-A), citing regulatory overreach and a lack of consultation with Congress.

Metal futures markets heat up. Average daily volumes of futures and options traded on the London Metal Exchange hit a 10-year high of 730,385 lots per day in the second quarter of 2024, up 27% year-on-year, with nickel leading and copper in second place.

GM pays huge fine for misreported emissions. American car manufacturer General Motors (NYSE:GM) was fined $145.8 million and forfeited hundreds of millions of dollars worth of credit after a government investigation found that 2012-2018 cars emitted 10% more CO2 than reported.

European majors are fleeing West Africa. Nigeria’s upstream regulator NUPRC approved the sale of ENI (BIT:ENI) the local unit of the regional manufacturer Oando and the stripping of Equinor’s (NYSE:EQNR) stake in the OML 128 block and Agbami field to unknown Mauritius-based company Odinmim.

The Libyan oil minister resigns again. Libya’s oil minister, Mohamed Oun, has “temporarily resigned” from his position after Prime Minister Dbeibeh appointed his deputy to the post, with oil investors increasingly fearful about the fate of the historic 2024 licensing round.

Shell takes heavy damage. Shell announced it would take an impairment charge of up to $2 billion following the sale of its Singapore refinery to Glencore and the recently announced suspension of construction on its 820,000 mtpa biofuel plant in Rotterdam, citing weak market conditions.

Hurricane Beryl slows before making landfall. Hurricane Beryl, which has wreaked havoc in Jamaica, is expected to move north and make landfall on the Texas coast early next week, but by then it is not expected to damage US Gulf platforms as Beryl has already weakened to a category 2 hurricane.

By Michael Kern for Oilprice.com

More top reads from Oilprice.com

Image Source : oilprice.com, https://www.pexels.com/

Leave a Reply