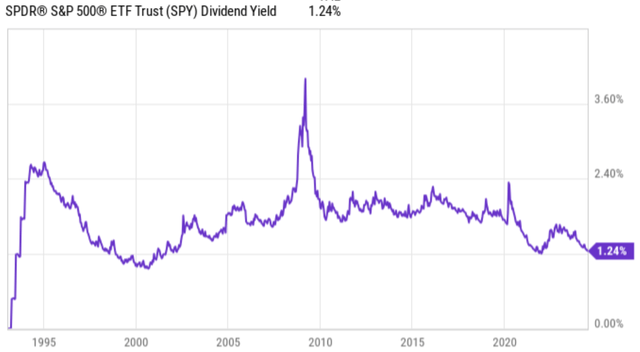

Earning a decent income stream from investing in the broader market seems more difficult every day, especially as the S&P 500 ( SPY ) continues to set new records. This has resulted in a rapid decline in the dividend yield, which now stands with only 1.24%.

As shown below, the S&P 500 yield now sits at its lowest level since 2021 and is hovering near the multi-decade low reached during the tech bubble from 2000.

While one could argue that the impressive growth in SPY makes up for the low dividend yield, one has to wonder how sustainable those gains are and whether we are in bubble territory. As shown above, the SPY’s yield increased in the years after 2000, and this was largely driven by the index’s 47% decline from its peak.

That’s why I remain heavily allocated to income stocks that are far from overvalued in today’s volatile market. This brings me to the following 2 stocks, which yield 7-10%, giving investors significant income and capital appreciation potential. Let’s explore why each makes sense for a diversified income portfolio!

#1: Lending underwritten by Blackstone

Blackstone Secured Lending (BXSL) is a BDC that is externally managed by leading asset management firm, Blackstone (BX), which has over $1 Trillion in assets under management across credit, real estate and infrastructure assets.

I last covered BXSL in March, highlighting its strong dividend coverage and balance sheet with a growth trajectory. The stock is up 5% since then, with a total return of 10% including dividends, outperforming the 8% gain in the S&P 500, as BXSL continues to demonstrate sound fundamentals with continued NAV per share growth.

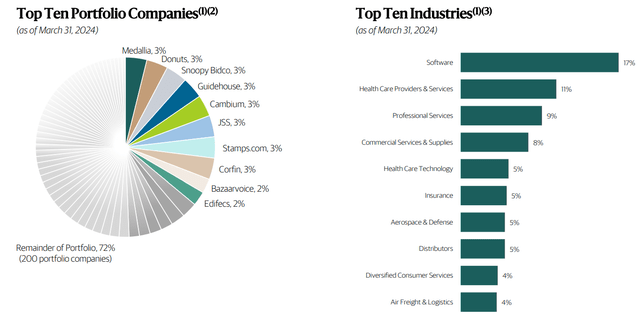

BXSL has assembled a sizeable portfolio with a fair value of $10.4 billion that is spread across 210 companies. The portfolio is diversified across both defensive and growth industries, with no single company representing more than 3% of the total portfolio. As shown below, software, healthcare, professional services and business services represent BXSL’s main segments accounting for 50% of the total portfolio.

BXSL benefits from a conservatively managed portfolio amid economic uncertainty, with 98.5% of its loans secured by first liens and a weighted average loan-to-value ratio of 48%. This helped BXSL achieve a strong annual return on equity of 13.1% and NII per share of $0.87 during Q1 2024.

This equates to a safe dividend coverage ratio of 113%, based on the current quarterly dividend rate of $0.77. The dividend yield increased by 10% over the past 12 months and remains materially higher than the quarterly rate of $0.53 at the time of BXSL’s 2021 IPO.

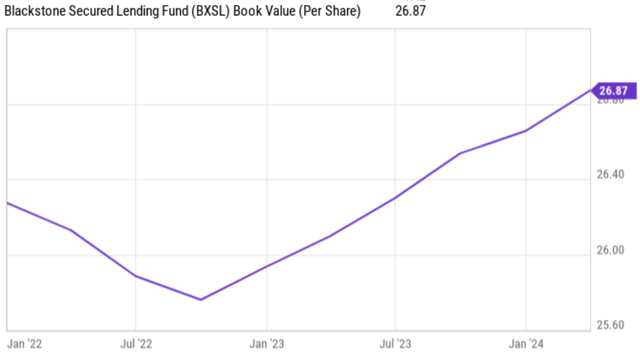

Notably, BXSL has increased its NAV/share for 6 consecutive months, including a continuous QoQ improvement of $0.21 since the end of 2023 to $26.87 currently. As shown below, NAV/share currently stands at an all-time high after more than recovering from lower market valuations in the portfolio when interest rates begin to rise in 2022.

BXSL also carries a very low non-accrual rate of just 0.1% as a percentage of portfolio cost. It’s also well-positioned for opportunistic growth with $1.4 billion in total liquidity with no debt maturities through 2026, and a debt-to-equity ratio of 1.03x, falling well below the 2.0x statutory limit for BDCs. This gives management capacity to pursue investments in the data center arena, which management noted as a high-conviction sector following BX’s acquisition of QTS Data Centers in 2021.

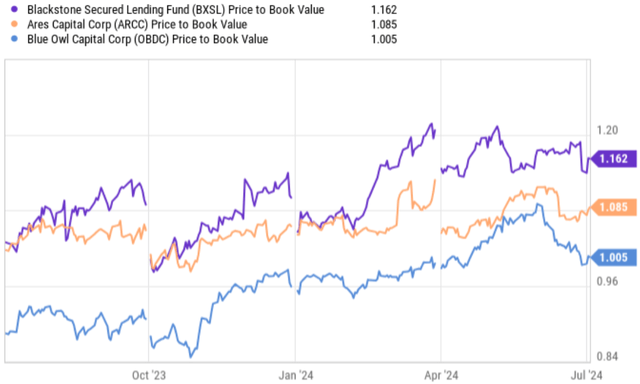

Admittedly, BXSL is not cheap for an externally managed BDC at the current price of $31.13 with a Price/NAV ratio of 1.16x. As shown below, this is at a premium to peers Ares Capital (ARCC) and Blue Owl Capital Corp (OBDC) of 1.09x and 1.0x respectively.

Trading at a premium to NAV is not a bad thing, however, as it opens up a source of accretive funding for equity issues. Furthermore, BXSL can be an excellent addition to a diversified income basket considering its very high first lien exposure combined with a stronger balance sheet and lower non-accrual rate compared to with the average of colleagues. With a dividend yield of 9.9%, investors are well compensated for paying a premium to book value.

#2: Imperial Brands

Imperial Brands ( OTCQX:IMBBY ) is perhaps the least followed tobacco name compared to much larger peers British American Tobacco ( BTI ), Altria ( MO ) and Philip Morris International ( PM ).

I last covered IMBBY in July 2021, highlighting its turnaround efforts to shore up its balance sheet and focus on core brands, along with deep undervaluation. It looks like my thesis paid off, with the stock up 19% and delivering a total return of 48% including dividends, far outstripping the 26% gain in the S&P 500.

IMBBY has continued to make solid progress in transitioning its portfolio towards NGPs (Next Generation Products). This is reflected in both IMBBY’s revenue and operating profit growing by 2.8% year-on-year for the six months ended March 31, 2024.

Additionally, adjusted EPS grew at a strong annualized rate of 7.7% over the same time period as IMBBY continues to focus on driving profitability. This was driven by strong tobacco price growth of 8.6%, more than offsetting a decline in fuel volume, and NGP revenue increased by 17%.

In particular, IMBBY is growing its market share in the US, Spain and Australia, which represent three of its top 5 markets. Newer products such as the 1000-puff Blu vape disposable bar and the new flavored Pulse 2.0 heated tobacco stick contributed to IMBBY’s expansion in Europe.

For the full year 2024, management is guiding for conservative single-digit revenue growth on an FX-neutral basis, underpinned by strong tobacco prices and continued growth support in next-generation products.

IMBBY carries a strong balance sheet with a BBB investment grade credit rating from S&P. It expects to achieve a net debt to EBITDA ratio of 2.0x by the end of this year, which puts it in line with the leverage targets of peers BTI, MO and PM.

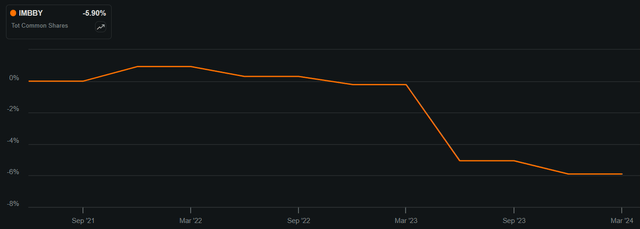

Importantly for income investors, IMBBY increased its interim dividend by 4%. The two interim dividends totaling 44.9 pence equate to a payout ratio of 37%, and I would expect the remaining 2 higher dividends to be covered by earnings as well. It is also worth noting that IMBBY has resumed share buybacks since 2023 with a 6% reduction in the number of shares, as shown below.

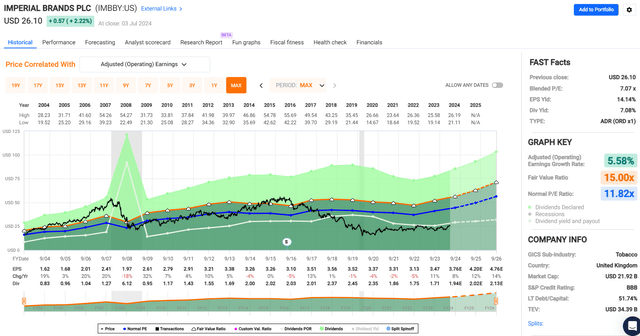

IMBBY represents solid value at the current price of $26.19 with a forward PE of just 7.8, sitting well below its historical PE of 11.8, as shown below.

While IMBBY is more expensive than BTI’s 6.8x PE, it is less expensive than MO and PM’s 9.0x and 16.1x PE ratios, respectively. Analysts estimate 6.2% EPS growth for IMBBY next year, which I believe is reasonable considering IMBBY’s demonstrated pricing power, NGP product growth and share buybacks. With a dividend yield of 7.1% and my long-term expectations for mid-single-digit annual EPS growth, IMBBY could produce sharp returns to the market even without a return to its mean valuation.

Investor Takeaway

Blackstone Secured Lending and Imperial Brands present compelling opportunities for income-focused investors in today’s market, offering high dividend yields and strong fundamentals. BXSL benefits from a diversified, conservatively managed portfolio with strong dividend coverage, NAV/share growth and a strong balance sheet, positioning it for growth and sustainable returns.

IMBBY is successfully transitioning its portfolio towards next-generation products, maintaining profitability and shareholder returns through strategic market expansion and prudent financial management. Together, these two stocks offer significant income and capital appreciation potential, making them potentially valuable additions to a diversified income portfolio.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. stock exchange. Please be aware of the risks associated with these stocks.

Image Source : seekingalpha.com, https://www.pexels.com/

Leave a Reply