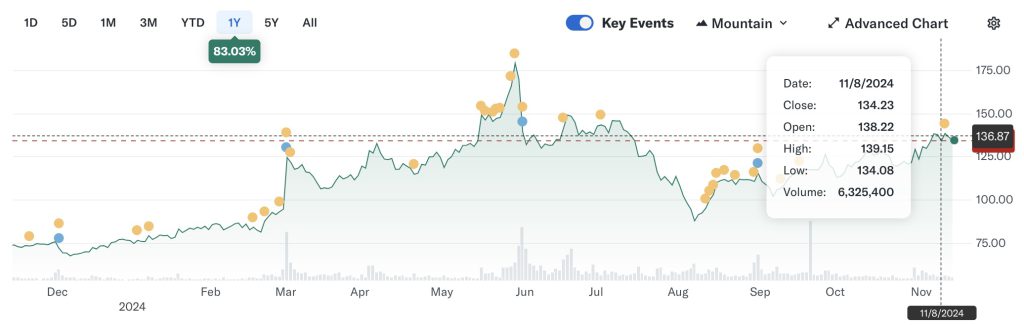

Dell Technologies (DELL) is a leading global technology company that designs, develops, and manufactures a broad range of products and services for businesses and consumers. Known for its strong presence in personal computers, servers, and storage solutions, Dell plays a pivotal role in the IT infrastructure industry. The company operates in several key sectors, including enterprise solutions, cloud computing, and artificial intelligence (AI)—all of which have contributed to its ongoing expansion. In recent years, Dell’s shares have surged, driven by solid growth in its server and infrastructure business, which makes up approximately 50% of its total revenue. Despite this growth, the stock remains undervalued, offering investors an attractive opportunity for long-term gains, particularly as demand for AI-optimized servers continues to rise. Here’s why Dell’s stock should reach new heights in 2025 and beyond.

Dell’s Growth Amid Challenges: A Balanced Performance

In the fiscal second quarter ending August 2, 2024, Dell’s revenue growth accelerated to 9% year-over-year (YoY), up from 6% in the previous quarter. Analysts project that Dell’s revenue will increase by 10% for the full year, signaling further growth in the second half of the current fiscal year.

A major driver of Dell’s performance has been its Infrastructure Solutions segment, which saw a remarkable 38% YoY increase in revenue. This was largely driven by record-breaking demand for servers and networking solutions—key products in Dell’s portfolio. This uptick in infrastructure demand has more than compensated for the softness in Dell’s PC business, where client solutions revenue fell 4% YoY.

While the PC business has faced challenges, there is optimism that demand will eventually rebound. Given that Dell is still achieving robust growth despite the downturn in PC sales, there is considerable potential for the stock to reach new highs next year if the PC market recovers.

Dell Is Positioned to Capitalize on the AI Boom

A key factor driving Dell’s growth is its strategic position in the AI server market. The company has been a strong contender in the race for artificial intelligence (AI)-optimized servers. According to Chief Operating Officer Jeff Clarke, Dell is successfully securing major AI contracts: “We are competing in all of the big AI deals and are winning significant deployments at scale.”

Dell estimates its addressable market for AI hardware and services to be worth $174 billion, growing at an impressive annualized rate of 22%. This market represents a generational opportunity for Dell, and with a market that’s roughly four times the size of its current infrastructure solutions segment, Dell is well-positioned to capitalize on this burgeoning sector.

Why Dell Is Undervalued and Poised for Growth

At a forward price-to-earnings (P/E) ratio of 17, Dell’s stock is trading on the lower end of the spectrum for companies in its sector, making it an attractive investment option. While Dell isn’t a high-growth tech company, it is deeply embedded in the server and PC markets, and its consistent track record of profitable growth makes it a solid long-term investment.

The company’s recent share buybacks also signal confidence in its undervaluation. Last quarter, Dell repurchased 5.5 million shares at an average price of $130.03, signaling management’s belief that the stock is currently undervalued. Since the beginning of fiscal 2023, Dell has returned $9 billion to shareholders through dividends and share repurchases—essentially using nearly all of its free cash flow during this period. This approach highlights Dell’s strong financial position and commitment to delivering shareholder value.

Looking Ahead: AI and Infrastructure Market Growth

Wall Street analysts forecast that Dell’s earnings will grow at a steady 12% annual rate in the long term. With AI-powered PCs set to become more prevalent next year, combined with ongoing strength in the server market, Dell is well-positioned for continued growth. As the company gains market share in the AI sector, it could see a significant upside.

Dell Shares Offer Strong Value in November 2024

At around $136 per share, Dell presents a compelling investment opportunity. With its solid growth in the AI and server markets, strong earnings potential, and commitment to returning value to shareholders, Dell shares are set to outperform the market in the years ahead. If you’re looking for an undervalued tech stock with significant upside potential, Dell Technologies should be on your radar this November.

Leave a Reply