In a significant step toward energy market reform, China has announced a policy shift that will allow renewable electricity to be freely traded, leaving local authorities responsible for implementing market-based pricing by the end of the year. This decision marks a crucial move toward reducing government subsidies for the clean energy sector and fostering a more competitive renewable energy market.

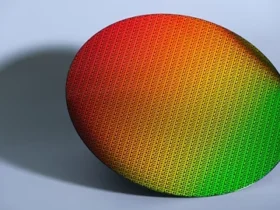

As the world’s largest greenhouse gas emitter and a global leader in renewable energy production, China has been aggressively expanding its wind and solar capacity. However, challenges remain, particularly in absorbing the surplus power generated. With the nation’s economy facing hurdles, the government is aiming to strike a balance between maintaining affordable electricity prices and ensuring a sustainable energy future.

China’s Renewable Energy Market Shifts to Market-Based Pricing

The National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) have confirmed that renewable energy generators will be subject to new pricing mechanisms, transitioning away from fixed subsidies. While this means greater market flexibility, price stabilization measures will be put in place to prevent excessive volatility.

A key distinction is being made between existing and new renewable energy projects. Wind and solar installations commissioned before June 1, 2024, will continue to follow the current pricing model, while projects launched after this date will be evaluated under the new market-driven framework. This could lead to less favorable pricing for new developments, potentially encouraging a rush in installations before the cutoff date.

China’s Position as a Global Clean Energy Leader

China’s commitment to expanding renewable energy infrastructure has positioned it as a global leader in clean power generation. By 2023, the country had installed 1,410 gigawatts of wind and solar capacity, meeting its 2030 clean energy target six years ahead of schedule.

Despite this rapid expansion, renewable power supply has outpaced demand, leading to inefficiencies in the market. Additionally, regional governments have kept electricity prices low to support local economies, creating financial strains for power generators. The new policy aims to resolve this imbalance by allowing market forces to determine pricing while protecting consumers from drastic price hikes.

How the Policy Will Impact Businesses and Consumers

The Chinese government has emphasized that the shift will not affect residential or agricultural electricity prices. For industrial and commercial consumers, price changes will be minimal in the first year.

Analysts believe that these policies will bring greater flexibility to power pricing while maintaining affordable electricity costs for end users. By implementing balancing payments, similar to contracts for difference (CFDs) used in the UK, China aims to stabilize the market:

- If electricity prices fall below a certain level, the grid will compensate generators for the shortfall.

- If prices rise above a set threshold, generators will return the excess profit to the grid.

This mechanism is expected to mitigate financial risks for power producers and encourage smoother energy market transitions.

Potential Surge in Renewable Installations Before the Cutoff Date

The June 1 deadline for transitioning to market-based pricing could trigger a surge in new wind and solar installations. Developers may rush to complete projects under the existing subsidy system, aiming to secure higher guaranteed prices before the shift to market-determined rates.

Experts suggest that this rush may lead to short-term supply chain bottlenecks, increased demand for renewable energy components, and potential price fluctuations for solar panels and wind turbines. However, in the long run, a fully market-driven pricing model is expected to enhance efficiency, innovation, and private sector investment in clean energy.

China’s Push for Energy Market Reforms

The move to allow renewables to be traded freely aligns with China’s broader energy reform agenda, which aims to:

✅ Encourage private investment in clean energy projects.

✅ Enhance competition among energy producers.

✅ Improve pricing efficiency to reflect actual market demand.

✅ Reduce financial burdens on the government from renewable energy subsidies.

By adopting these measures, China is positioning itself as a leader in clean energy market liberalization, setting a precedent for other nations looking to transition to sustainable energy economies.

The Global Implications of China’s Energy Market Shift

China’s clean energy policy has far-reaching implications for global markets. With the country accounting for one-third of the world’s renewable energy capacity, changes in its pricing policies could:

🌍 Influence international investment in wind and solar energy.

🌍 Impact global supply chains for renewable energy components.

🌍 Encourage other nations to explore market-based pricing for green energy.

As China moves toward greater energy independence, foreign energy investors and global manufacturers will be closely watching how the policy unfolds.

Conclusion: A New Era for China’s Renewable Energy Market

China’s decision to transition renewable energy to a market-based pricing system marks a significant milestone in its clean energy evolution. While the policy change may create short-term uncertainties, it is expected to drive long-term sustainability, efficiency, and innovation in the sector.

With its massive clean energy investments, rapid technological advancements, and market-oriented reforms, China is set to redefine the future of global renewable energy economics. As this transformation unfolds, businesses, investors, and policymakers worldwide will be closely monitoring the impact of this historic shift toward market-driven clean energy pricing.

Leave a Reply