Intel’s Ambitious 18A Rollout Hits Early Roadblocks

Intel (NASDAQ: INTC) has invested billions in developing its advanced 18A manufacturing process, aimed at producing 24A and beyond competitor-class chips like “Panther Lake.” The company has upgraded fabs and projected 18A as a game-changer to challenge semiconductor giant TSMC. However, cutbacks in yield during early testing threaten Intel’s hopes for U.S.-based foundry success.

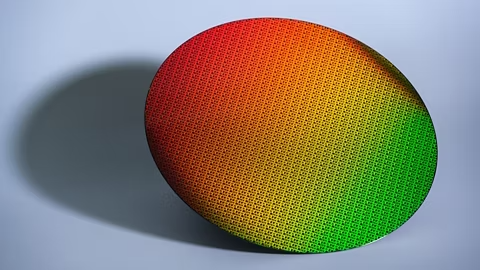

Why Yield Is a Critical Metric for Chip Production

Yields—or the percentage of chips passing quality specs—are foundational to profitability. Sources briefed on Intel’s internal results revealed that only a tiny fraction of Panther Lake chips manufactured on 18A meet specification. That low yield could make high-end laptop volume production unprofitable—unless resolved.

Intel CFO David Zinsner acknowledged the issue: “Yield tends to start low and gradually rise.” Still, insiders say Intel historically postpones large-scale ramp-up until yields exceed 50%, and ideally aim for 70–80% for margin support.

Panther Lake Yield Still Far Below Requirements

Earlier internal data indicated only about 5% of Panther Lake chips met spec requirements. Recent testing hinted at improvement to roughly 10%, although companies often report inflated numbers by including near-spec products, sources indicated. Even then, Intel would need a steep yield increase before full-scale production, which may not happen by the fourth-quarter 2025 launch.

Risky Leap: Intel’s ‘Hail Mary’ Strategy

Intel’s shift to 18A packed several innovations—advanced transistor designs and enhanced power delivery structures—all at once. According to internal sources, this aggressive approach resembled a “Hail Mary,” introducing complexity and delays. While meant to narrow the gap with TSMC, the fast-tracked rollout appears to have stretched Intel’s manufacturing capabilities.

Company Pushes Outlook Despite Challenges

Intel reaffirmed that Panther Lake remains “fully on track” in a July 30 statement, citing improving yields and expected success in the notebook market. Zinsner told Reuters Intel anticipates yield improvements every month, with hopes for production-ready levels by year-end. Still, he added that even if yields hit targets, margins may remain muted until further improvement.

Financial Implications of Yield Shortfalls

A low yield on premium chips like Panther Lake forces Intel into tough choices: sell at a loss, accept lower production volumes, or delay rollout. If Intel misses key yield benchmarks, profit extraction becomes difficult—especially as margins depend on high volume production.

Those issues have spurred internal debate about the economics of continuing in-house leading-edge manufacturing versus relying on external foundries.

Contract Manufacturing Risks Persist for Intel

Intel CEO Lip‑Bu Tan has emphasized the transition toward a contract semiconductor business, signaling more reliance on TSMC for future production. Even the next-generation chip—Nova Lake—is expected to be partly produced by TSMC, as manufacturing challenges persist at Intel’s own fabs.

Tan’s strategy includes collaboration with supply chain partners and sharing yield data to improve internal production. But for now, Intel remains partially dependent on TSMC to meet its internal chip demands.

What’s at Stake: Industry Leadership and U.S. Chip Sovereignty

Intel’s ability to master the 18A process is pivotal for reshaping its foundry ambitions and advancing U.S. semiconductor manufacturing leadership. Persistent yield issues may force Intel to choose between its national strategy and commercial viability—raising broader questions about reshoring chip production.

Next Steps & Outlook

As Intel strives to boost 18A yield and prepare for mass production of Panther Lake, investors and analysts will monitor developments closely. Improvement or delays will also shape the company’s longer-term foundry roadmap, including bets on upcoming nodes like 14A—which could hinge on closing the yield gap with rivals.

Until then, Intel faces pressure to prove its newfound competitiveness amid changing leadership, financial performance targets, and government investment in chipmaking.

Reference : Jeffrey Dastin and Max A. Cherney

Leave a Reply