(Bloomberg) — Stocks joined gains in bonds after the latest jobs report reinforced bets that the Federal Reserve will cut interest rates this year.

Most Read by Bloomberg

The S&P 500 hit a new record high and Treasury yields fell along the curve after data showed U.S. employment moderated in June while the jobless rate rose to the highest level since late 2021. Swaps currently forecast almost two Fed rate cuts in 2024 and bets are increasing around the September start of the policy easing cycle.

Nonfarm payrolls rose by 206,000 in June and job gains in the previous two months were revised up by 111,000. The median forecast in a Bloomberg survey of economists called for an increase of 190,000. The unemployment rate rose to 4.1%, and average hourly earnings contracted.

“Get on with it,” said Neil Dutta at Renaissance Macro Research. “Today’s employment report should bolster expectations for a September rate cut. Economic conditions are cooling and that makes tradeoffs different for the Fed.”

Two-year yields fell 10 basis points to 4.61%. The S&P 500 hit 5,550. Tesla Inc. rose for an eighth consecutive session – the longest winning streak since June 2023. Macy’s Inc. rose 13% on a news report of a sweet buyout offer. Nvidia Corp. fell, with one analyst downgrading the stock on valuation concerns.

Bitcoin sank amid concerns about potential sales by governments, creditors of a failed exchange and beleaguered crypto miners. The pound led gains among major currencies after Keir Starmer’s Labor Party cruised to a landslide election victory, fueling hopes of a period of political calm and a stable approach to the country’s finances.

The gradual easing of a very tight labor market is consistent with the Fed’s “immaculate disinflation narrative” and should give officials confidence to cut rates sometime in the second half, according to Michael Feroli at JPMorgan Chase & Co.

He still sees a first cut in November – but says the path to September relief became “a bit wider”.

“The labor market is bending without breaking yet, which increases the case for rate cuts,” said David Russell at TradeStation. “Things are not too hot and not too cold. Goldilocks is here and September is in play.”

While the June jobs report beat expectations, other components within the data continued to highlight a softening labor market, noted Bret Kenwell at eToro.

The story continues

“Consensus expectations call for a September cut, and today’s jobs report should boost investor confidence in that scenario,” he said.

Chris Larkin at Morgan Stanley’s E*Trade says the latest jobs data suggests the labor market is slowing — perhaps not enough to accelerate rate cuts, but perhaps enough to keep the Fed on track for September.

“Net-net, this was good news for the Fed,” he noted.

At Apollo Global Management, Torsten Slok’s view remains unchanged – no Fed tapering in 2024.

He says the jobs report confirms it will take time for the Fed to calm the economy and inflation.

“Looking ahead, the main discussion in the markets will be whether this cooling will accelerate to the downside due to still high financing costs. Or whether we’ll see the economy re-accelerate due to high stock prices and tight credit spreads,” Slok noted.

After the jobs data comes Fed Chairman Jerome Powell, who will give his biennial testimony on Capitol Hill at 10 a.m. in Washington on Tuesday. Then the consumer price index is published on Thursday.

“If next week’s CPI is cooperative, the case for a September cut will be much stronger,” said Chris Low at FHN Financial.

For Michael Reynolds at Glenmede, iInvestors should circle the Fed’s September meeting as the first truly “live” meeting for rate cut considerations.

“But they should make sure they use a pencil with a good eraser in case inflation doesn’t cooperate by then,” he added.

Wall Street’s reaction to jobs:

This jobs report could give the Federal Reserve the confidence to cut interest rates in September, as despite inflation remaining above target, the labor market shows clearer signs of cooling. This is the kind of jobs report the Fed has been predicting: softer but still good data that could justify two rate cuts this year.

The stock market may be a little conflicted about how to respond to today’s jobs report. On the one hand, the downward revisions of previous months and the rise in the unemployment rate increase the chances of a Fed rate cut in September – bond markets are certainly celebrating this. But the same figures cannot but cause concerns about the direction of the American economy. A broad swath of economic data all point to a softening – today’s report adds to that picture.

So far, we don’t see apocalyptic signs within the labor market, but investors should be cautious when the labor market is supported by government payrolls. The downward revisions of the previous two months are consistent with an economic slowdown. We should expect more rhetoric from the Fed on labor market conditions and the importance of keeping policy appropriate for their dual mandate.

With the Federal Reserve seeing inflation data in the statistical neighborhood where it wants to be, it is expected to cut interest rates in September. If the labor market continues to cool and inflation allows, the central bank will shift some of its attention from stable prices, part of its mandate, to increasingly focus on the other issue of maximum employment. .

The higher unemployment rate suggests a broader economic slowdown. The cooling in the labor market, despite a higher-than-consensus estimate of payroll compression, foreshadows a broader economic downturn as the all-important consumer becomes more concerned about the ability to find new jobs as well as the security of continuous work.

New York Fed Bank President John Williams said that while inflation has recently cooled toward the Fed’s 2% target, policymakers are still some way off their target.

Bond funds posted about $19 billion in weekly inflows, the biggest additions since February 2021, according to a note from Bank of America Corp. citing EPFR Global data. The trend suggests investors are “locking in at maximum yields,” strategist Michael Hartnett wrote.

About $51.9 billion flowed into cash funds in the week to July 3, the biggest increase in two months. Global equity funds record inflows of $10.9 billion in longest winning streak since December 2021.

Traders are also watching for any developments regarding the US presidential race. Joe Biden is entering the most important weekend of his political career, knowing that he must restore the confidence of voters, donors and party officials who are deeply skeptical of his acuity — and that any misstep will be fatal to his re-election campaign.

Corporate Highlights:

- Canada has approved Glencore Plc’s $6.9 billion takeover of Teck Resources Ltd.’s coal metallurgical business, while the latter announced a $2 billion share buyback and pledged to increase copper production.

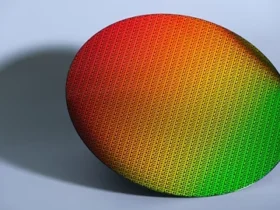

- Samsung Electronics Co. posted its fastest pace of sales and profit growth in years, reflecting a recovery in demand for memory chips as AI development accelerates globally.

- BBVA SA investors voted to back the lender’s bid for rival Banco Sabadell SA, allowing chairman Carlos Torres to overcome a setback in his bid to create a domestic banking giant.

- Shell Plc expects up to $2 billion in hits to its second-quarter earnings related to a delayed biofuels plant under construction in the Netherlands and its chemicals facility in Singapore.

Some of the main movements in the markets:

INVENTORY

- The S&P 500 was up 0.3% as of 11:44 a.m. New York time.

- Nasdaq 100 rose 0.8%

- The Dow Jones Industrial Average was little changed

- Stoxx Europe 600 fell 0.2%

- MSCI World Index rose 0.2%

currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.1% to $1.0827

- The British pound rose 0.4% to $1.2808

- The Japanese yen rose 0.3% to 160.75 per dollar

Cryptocurrencies

- Bitcoin fell 3.1% to $56,536.62

- Ether fell 4.6% to $2,998.7

BONDS

- The 10-year Treasury yield fell eight basis points to 4.28%

- Germany’s 10-year yield fell five basis points to 2.56%

- Britain’s 10-year yield fell seven basis points to 4.13%

wares

- West Texas Intermediate crude rose 0.4% to $84.24 a barrel

- Spot gold rose 1.2% to $2,384.33 an ounce

This story was produced with the help of Bloomberg Automation.

–With assistance from John Viljoen, Divya Patil and Richard Henderson.

Most Read by Bloomberg Businessweek

©2024 Bloomberg LP

Image Source :https://www.pexels.com/

Leave a Reply